Headquartered in Singapore, the Oversea-Chinese Banking Corporation (OCBC) is the second largest bank in Southeast Asia.

OCBC consistently ranks amongst the World’s Safest Banks, and has more than 570 branches around the world. Well, why are OCBC business accounts one of the most popular amongst companies?

With a host of stellar financial products, OCBC has no problem winning the hearts of Singaporeans and businesses. Looking for a business account for your company? Read on to find out if OCBC fits the bill.

What business accounts are offered at OCBC?

OCBC offers three different business accounts:

1. The Singapore dollar accounts offered are the: Business Growth Account and Business Entrepreneur Account Plus.

2. OCBC also provides foreign currency accounts, such as the Multi-Currency Business Account.

Each account is tailored to the needs of various company sizes and types:

Which OCBC business account should I choose?

1. OCBC Business Growth Account

The Business Growth Account and Business Entrepreneur Account are Singapore dollar accounts—perfect for business owners looking to set up shop in Singapore.

With no minimum balances or deposits, and a low monthly maintenance fee, the OCBC Business Growth Account remains one of Singapore’s most popular business accounts.

The only cost you’ll have to bear is a monthly service fee of S$10. Overall, this OCBC business account is great if you’re just starting out.

2. OCBC Business Entrepreneur Account

Alternatively, there’s OCBC’s Business Entrepreneur Account Plus. Although this business account has no monthly fees, it does have a rather high minimum deposit and daily balance of S$30,000.

With a S$30,000 minimum daily balance, this account is best for larger companies with significant cash flow. OCBC’s Business Entrepreneur Account Plus targets companies looking to expand.

We recommend start-ups and new businesses to consider the costs of the Business Entrepreneur Account Plus before committing.

3. OCBC Multi-Currency Business Account

On the other hand, we have OCBC’s Multi-Currency Business Account. As one of OCBC’s foreign currency business accounts, it covers transactions in 13 different foreign currencies.

This account allows companies to deal directly in their chosen foreign currency. That means more savings on currency conversions.

If your company deals in overseas transactions, the Multi-Currency Business Account might be the OCBC business account for you.

How do I open an OCBC business account?

The process of opening a OCBC business account differs depending on which account you choose.

Out of the three OCBC business accounts offered, the Business Growth Account and Multi-Currency Business Account can be opened online. You’ll need:

- OCBC Personal Internet Banking information

- Singpass account

This process is different if you’re opting for the Business Entrepreneur Account Plus. You’ll have to complete an online application before heading down to a bank branch for an appointment.

Tired of having to head down to the bank?

You’re in luck. There’s one business account in Singapore that can be opened entirely online. Open your business account in minutes with Aspire.

At Aspire, creating a business account is free, No monthly fees, minimum deposits, or minimum balances, even if you’re on the hunt for a multi-currency account. Deal in 40 different foreign currencies and save while you’re at it—perfect for businesses that dabble in foreign transactions.

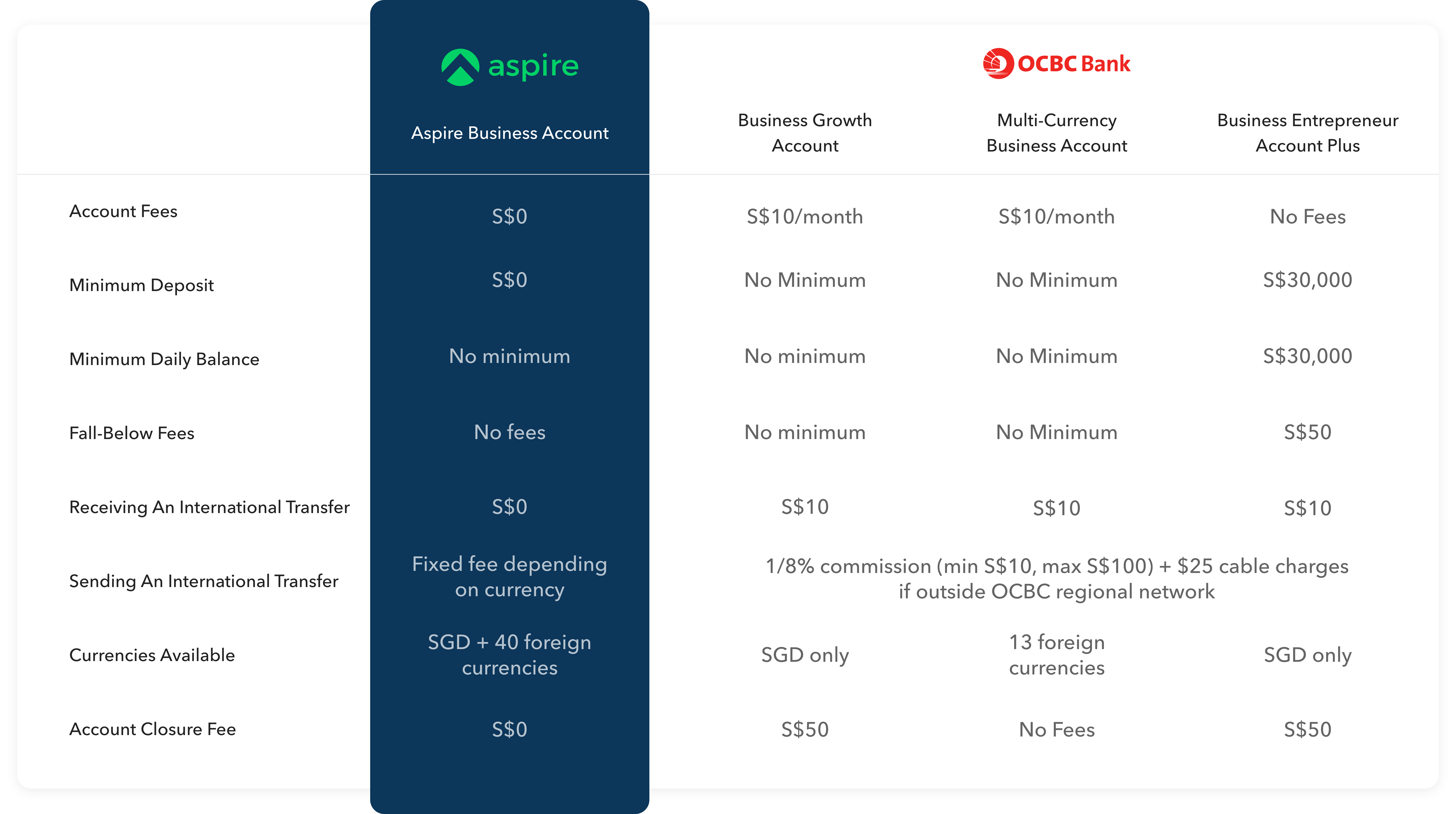

We’ve come up with a table summarising the different costs of opening a business account with OCBC and Aspire:

Business banking is a walk in the park with Aspire.

.svg)